Ensuring a resilient investment strategy for the long-term

The impact of COVID-19 has highlighted the need for schemes to think longer-term and embrace a resilient funding and investment strategy to ensure a smoother ride through turbulent times. Here we explore what makes a resilient investment strategy, with a case study on how Citrus has held up strongly over the past year compared with traditional portfolios.

What makes a resilient investment strategy?

We believe that a resilient investment strategy:

- Provides enough return to meet a scheme’s funding requirements while reducing risk by:

- Being well-diversified and balanced across different asset classes.

- Having a reduced reliance on volatile return-seeking assets (e.g. equities) and increased reliance on stable, income generating assets;

- Reduces variability in the scheme’s funding level. As the value of liabilities is greatly impacted by changes in future interest rates and inflation expectations, this means investing as much as possible in assets such as bonds, which react in a similar way to these changes and ‘match’ the movement in liabilities.

Making use of the latest funds and innovations, schemes can take advantage of synthetic assets and enhance capital efficiency of their investments - essentially making the scheme’s assets work harder and providing better value for money. At a time when schemes are increasingly becoming cashflow negative, this approach can help deliver significant and regular income which reduces transaction costs of disinvesting and helps to manage cashflow-related risks.

A resilient investment strategy in practice: Citrus case study

Citrus’s investment strategy has helped member sections navigate the recent COVID-19 market environment in two key ways:

- Diversification. The Plan invests in a greater variety of different asset classes. By pooling member sections’ assets together, Citrus can access a wide range of best-in-class managers and funds which smaller schemes struggle to invest in on a standalone basis due to minimum investment sizes or costs of investing.

- Capital efficiency. When seeking to invest in assets to match the movement in liabilities, most traditional portfolios are constrained by the amount of assets they have ‘spare’, once the need for investment return has been satisfied. Citrus is able to break this link and invest more in matching assets, by investing in ‘synthetic’ assets. These assets allow the plan to gain the same £ exposure to a particular asset, with a smaller £ investment, freeing up funds to invest elsewhere. Given the significant changes in both interest rates and inflation over 2020, this additional protection has been very beneficial to member sections.

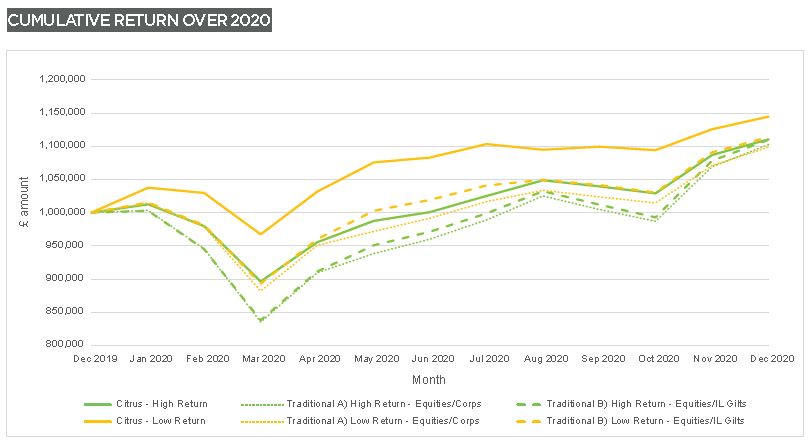

To illustrate the benefits of Citrus' diversified strategy, the chart below shows the returns generated by two different Citrus portfolios, one targeting a higher expected return and the second a lower expected return. These are then compared to more traditional investment portfolios that typically invest in just equities and bonds. The portfolios target the same level of return as the Citrus ‘higher return’ and ‘lower return’ portfolios by investing in either Equities and Corporate bonds or Equities and Index-Linked Gilts.

Please note when Q4 2020 performance hasn’t been readily available, performance has been calculated using a rollforward of estimated benchmark returns prior to final data being available.

So how do the strategies stack up?

Both Citrus portfolios (continuous blue and yellow lines) experienced a much smoother journey over the year (with much less significant falls during the very volatile period in March 2020). The positive impact of these less significant falls is particularly clear for the lower returning (and lower risk) Citrus portfolio which ended the year comfortably ahead of its comparison portfolios.

In addition, the Citrus portfolio has allowed a higher level of investment in matching assets over the period, reducing volatility not just within the assets as shown above, but in the resulting funding levels for each member scheme.

How can you achieve these outcomes for your scheme?

The advantage Citrus has over many standalone schemes is economies of scale. By pooling member sections’ assets together, Citrus can access best-in-class managers and funds which smaller schemes struggle to invest in on a standalone basis due to minimum investment sizes or costs of investing – including private debt and infrastructure.

Investment strategies within the Citrus DB master trust are driven by a clearly defined funding and investment framework. The strategies are tailored to the needs of individual sections, based on the objectives agreed with each employer, and will evolve as schemes’ circumstances and market conditions change. In addition to improving resilience to future shocks, a participating scheme could expect a c25% improvement in the expected return for each unit of investment risk taken – a very material improvement for both employers and members.

While moving your DB scheme into a master trust arrangement like Citrus could have many benefits, it’s important to do thorough research and due diligence to make sure it is the right solution for your scheme.

If you’d like more information on the investment strategy within Citrus and how it can help improve your scheme’s resilience in the long-term, please get in touch.