Is now the time for Defined Benefit master trusts?

With consolidation and cost saving rising up the agenda of companies with Defined Benefit (DB) schemes, for many the time has now come for the DB master trust. While Defined Contribution (DC) master trusts have captured the imagination in recent years, they’re yet to really take off in the DB world.

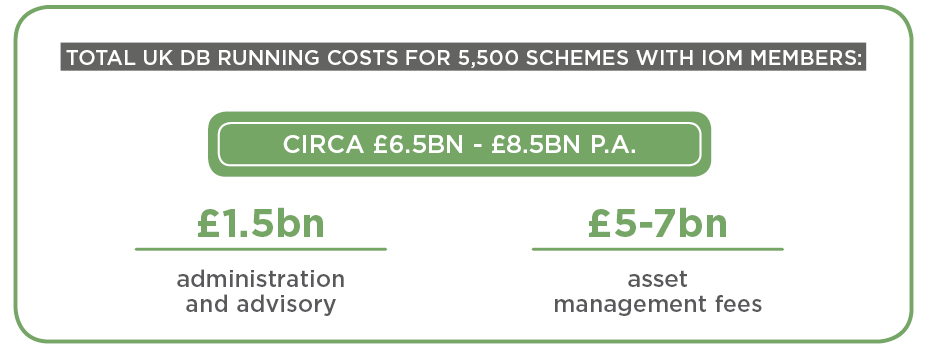

The costs of running DB schemes have soared in recent years. The c.5,500 DB pension schemes in the UK spend around £6.5bn-£8.5bn in running costs every year, and despite UK companies committing billions in deficit contributions, most have seen deficits rise.

What is a master trust?

DB master trusts are an efficient, affordable way for employers to ensure their employees’ pension needs are taken care of in a quality pension plan managed by experts.

Employers transfer their scheme’s assets and liabilities into a section of a larger trust, then close down their old scheme. This consolidates the running of the scheme into the DB master trust alongside other schemes and employers, with no cross subsidy of risk. Employers benefit from economies of scale and improved governance from being in the DB master trust with others, while still maintaining control over funding strategy and risk. A key benefit of scale is opening up the universe of investable assets that are not usually available to schemes with assets of less than £200 million.

With an increasing number of DB master trusts coming into existence over the past few years, now is the time to assess whether a master trust might be right for your scheme.

With consolidation and cost saving rising up the agenda of companies with Defined Benefit (DB) schemes, for many the time has now come for the DB master trust.

Hymans Robertson

Why move to a DB master trust?

DB master trusts have several benefits, making them an attractive option for those managing smaller schemes. These include:

- Reduced scheme running costs- a master trust reduces operating and administration costs by providing centrally shared reporting, communication and governance

- Simplified operations and governance – the experienced master trustee board takes on the duties of the trustees, taking away these responsibilities from the employer

- Risk management - covenant, funding and investment risk are managed by the master trust, reducing the risk to the employer

- Wider choice of investments - pooling of investment funds from multiple schemes means greater access to asset classes, along with reduced fund management and administration charges

- Getting to buy-out sooner - grouping sections together provides insurers with a more attractive proposition leading to lower buy-out costs

- Retention of control - the objectives and design of the scheme are still controlled by the employer, and can be tailored to your requirements

- Better service for members

Members have online access to statements and benefit information as well as support services

Is a master trust right for your scheme?

While there are many benefits of moving to a DB master trust, it is important to do thorough research and due diligence to make sure it is the right solution for your scheme.

For more information on DB master trusts and how Citrus could help your scheme, please contact us.