FAQs

Citrus is a not-for-profit Defined Benefit (DB) master trust, one trust in which each employer has its own section.

We partner with you to deliver your members’ benefits safely and cost effectively.

We’re run by employers, for employers. You retain control while we do the rest; improving your journey through our independence, expertise and resource.

We listen to your objectives and tailor our best practice governance to drive positive outcomes – for you, your scheme and its members.

Download our brochure to understand how Citrus can help you.

DB master trusts are an efficient, affordable way for employers to ensure their DB scheme is taken care of in a quality pension plan managed by experts.

Employers transfer their scheme’s assets and liabilities into their own ‘section’ of a larger DB trust, and then close down their old scheme. This consolidates the running of the scheme into the DB master trust alongside other former schemes and employers. There is no cross-subsidy of risk between different employers. The DB master trust will have its own advisers, and may also provide a new trustee board to support all of the sections.

Download our brochure to see how a DB master trust can help you.

A DB master trust is just one of a number of options available to employers with DB schemes to help reduce cost and ultimately improve the security of peoples’ pensions.

Consolidation of DB schemes has been gaining momentum in recent years and increasing amounts of attention. Due to high profile scheme failures and headlines about the plight of members, the prevailing view is that the DB market, particularly for smaller schemes, could function better if the inter-related factors of scale, poor governance and high costs are tackled.

Consolidation is an area of focus for the Department for Work and Pensions (DWP) on the future of DB pensions, a core recommendation from the Pensions and Lifetime Savings Association (PLSA) DB taskforce, and The Pensions Regulator repeatedly highlights the regulatory and governance challenges posed by small DB schemes.

Consolidation should be considered in the context of your long term strategy to identify the role it could play in your scheme’s future, and understand which option may lead to the best outcomes for your particular scheme.

There are many reasons to consider moving to a DB master trust, particularly if the investment, advisory and administration fees are higher than average for your scheme.

It is important to do thorough research and due diligence to ensure a DB master trust is the right solution for you. Contact us to discuss your scheme's strategy and the role a DB master trust could play in helping you meet your long term objectives.

The key benefits of joining include:

Manage costs at every stage of your journey

As a not-for-profit, the economies of scale we achieve are passed onto you.

This, combined with our independent structure and effective use of resource, ensures cost management at every stage of your journey.

Retain control of your scheme

Through partnering with you, you retain control of your scheme, and we deliver the rest.

If you’d prefer to stay involved, our employer oversight board enables all employers to play a more active role if you’d like.

Gain access to professional expertise and resource

Every person involved in making your journey a success has been independently selected because of their expertise and ability to address the challenges you face.

Led by a professional sole trustee and supported by knowledgeable advisers, we believe we are unique in our independence and expertise.

Developed by employers, for employers, we will address the challenges you are facing using a robust and efficient framework.

Improve your scheme’s governance

Experienced advisers manage the day-to-day running of things, allowing you to concentrate on your business.

Drive a more sophisticated investment strategy

A key benefit of scale is opening up the universe of investable assets that are not usually available to smaller schemes. We’ve also worked with fund managers to develop innovative capital efficient investment strategies. These achieve the same returns but require less capital to do so, ensuring your assets work harder and deliver more value to you and your scheme’s members.

Save management and trustee time

Less time spent on managing your pension scheme and attending trustee meetings

Reach your endgame sooner

Grouping sections together provides insurers with a more attractive proposition, leading to lower buy-out costs and bringing wind-up forward by up to 12 months.

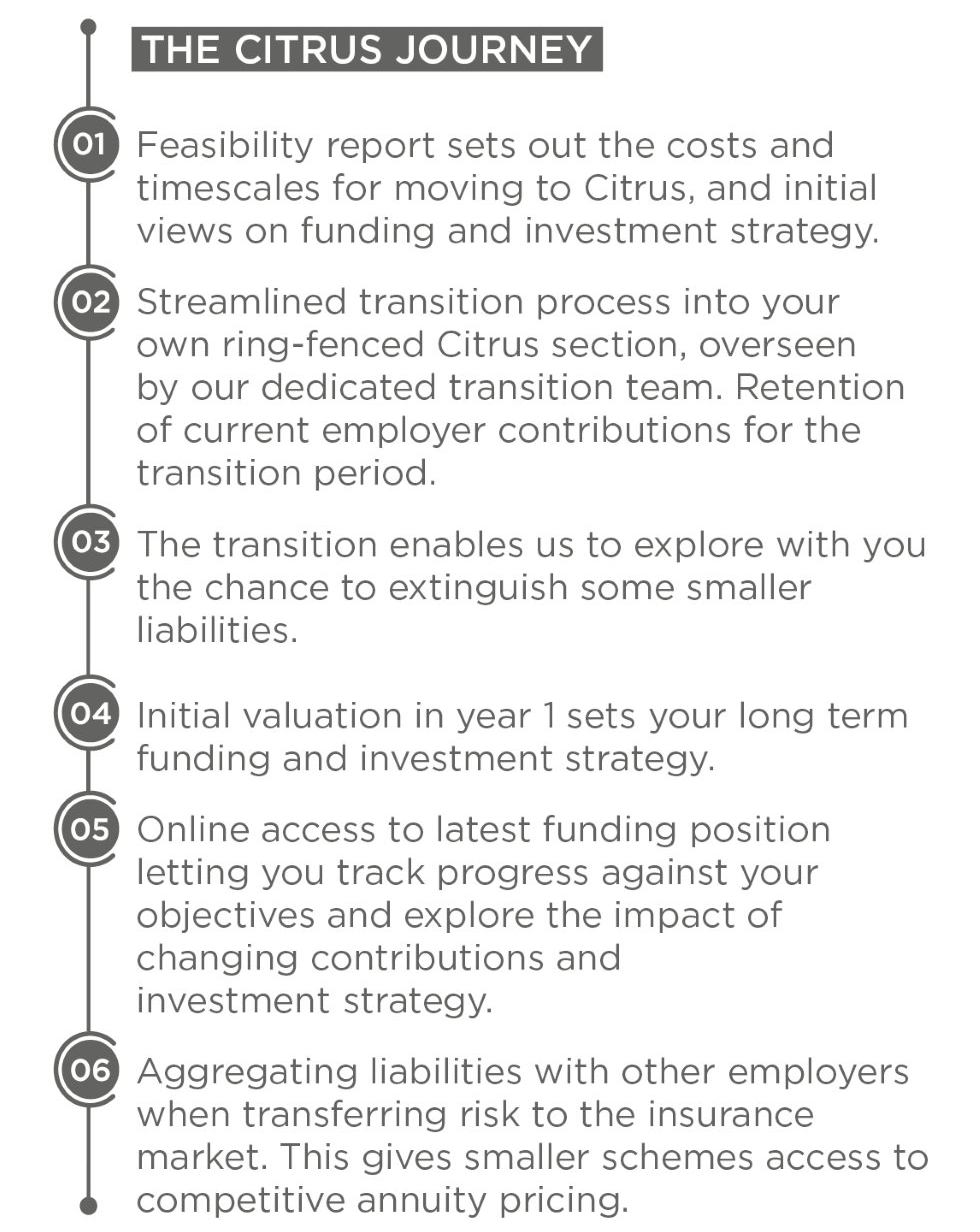

We’ll give you peace of mind throughout the joining process, with a tried and tested approach, managed by experts.

There are several different approaches for moving your current assets into Citrus. We would then arrange for your assets to be invested in an appropriate way to support your funding strategy. We have a track record in delivering the same expected returns at lower risk than you may currently run.

Our investment pre-transition plan will detail all the processes and timescales, always reducing out-of-market risks. We will set out who has responsibility for each aspect of the transition and prepare a post-transition report which summarises the activity carried out and the new asset allocation.

We work with your scheme's trustees and administrators to transition the administration of your scheme as smoothly as possible.

We would appoint a project manager and produce project control documents for implementation that set out the scope, project plan, key milestones and objectives of the project, including member communications and reporting to the Pensions Regulator.

To ensure members do not suffer reduced levels of service during the transfer of administration, we will work closely with the current administrators on the handover plan to cover the transition period.

The average time for moving over all the above aspects is around 4-6 months, meaning that you will be able to enjoy the benefits of a master trust quicker than you may have thought.

Citrus is supported by an experienced team of advisers who manage the day-to-day running of the Plan, allowing employers to concentrate on running their business. This offers a great benefit in terms of reduced governance for employers from not running their own trustee board, and having lighter-touch involvement going forward.

The employer oversight board enables all employers to play a more active role if they'd like.

Through partnering with you, you retain control of your scheme, and we deliver the rest. If you’d prefer to stay involved, our employer oversight board enables all employers to play a more active role if you’d like.

This means you can focus on strategic outcomes for your scheme, while leaving the best practice governance down to the Trustee.

A master trust can be used as a stepping stone to your longer-term goals. Most schemes, especially those with closed sections, will (ultimately) want to target an insurance solution in future, allowing them to pass on all future costs and risks to an insurance company.

Citrus aims to achieve this objective around the time when we expect there to be only pensioner members remaining in a section – this is the point at which insurance solutions tend to be most affordable.

The multi-employer nature of Citrus means it is likely that we will be able to take a number of sections to the insurance market together as part of a package, making the transaction more attractive to insurers. This is likely to lead to a better price. It also means these sections will then be looking to wind up over similar time-frames, with the prospect of reduced wind-up costs through the sharing of fixed costs.

The wind-up process takes around 12 months and we would provide a detailed project plan throughout.

There may be other reasons for wanting to exit Citrus. The Trustee doesn’t create barriers to leaving and is happy to engage in any proposals to leave. Exiting would initiate a similar process to joining; the approach is usually to make a bulk transfer out, provided that the Trustee is comfortable with the key areas of the proposal, and primarily that members' interests are protected. There is no last man standing arrangement in the majority of circumstances.

Our Statement of Investment Principles is made by the Trustee and details our investment approach and strategy.

Statement of Investment Principles

The Trustee have set engagement priorities which have been shared, alongside their RI policy, with the Plan’s investment managers. The Trustee will monitor the Investment managers’ developments throughout the year.

Find out more about our investment approach:

Read our Statement of Compliance with the Citrus Pension Plan’s Stewardship Policy for the year ending 31 March 2024.

The Trustee’s Stewardship (voting and engagement) Policy sets out how the Trustee will behave as an active owner of the Scheme’s assets which includes the Trustee’s approach to;

- the exercise of voting rights attached to assets; and

- undertaking engagement activity, including how the Trustee monitor and engage with their investment managers and any other stakeholders.

The Plan’s Stewardship Policy is reviewed on an annual basis in line with the Plan’s Statement of Investment Principles (SIP) review which was last completed in July 2024.

The DB Master Trust Self-Certificate is a new template in which DB Master Trusts can provide information – on a voluntary basis – on their structure, governance, operations, and on the process for joining and leaving the master trust.

You can find the latest version updated in November 2023 here.

Get in touch

If you have any specific questions, fill in our contact form to get in touch, and one of our team will get back to you.

Get in touch